Digital currencies and cryptocurrencies have been growing in popularity around the world, driven by technological innovation and the search for more efficient and secure alternatives to traditional currencies.

In this scenario, Brazil is currently developing Real Digital, its digital currency, which will be issued by the Central Bank of Brazil (BCB).

The aim of this innovation is to modernize the country’s financial system and keep up with the advances of new technologies in the Brazilian economy by issuing a CBDC (Central Bank Digital Currency).

Similar to other digital currencies issued by central banks, Real Digital faces challenges in terms of cybersecurity and data privacy, as it is essential to protect users’ information and transactions.

Real Digital: the importance of security in digital financial transactions

With the increasing digitalization of financial transactions, security is becoming a critical aspect and a mandatory requirement.

This leads us to consider several potential risks associated with the Real Digital environment, such as cyber attacks, fraud and identity theft.

However, for there to really be a cybersecurity risk scenario, it will be necessary for the origin of the crime to come from the Real Digital Blockchain network.

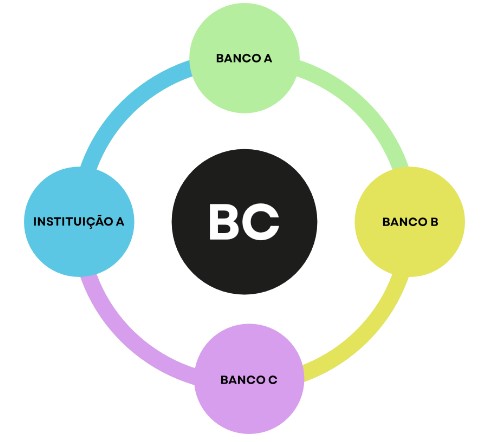

This structure is made up of entities that already participate in the RSFN (National Financial System Network).

The fact that Real Digital is being designed and developed based on the SFN architecture already significantly reduces the risk of security incidents.

From the point of view of cryptography, there are three main highlights in the Hyperledger Besu architecture:

- Use of TLS certificates;

- Use of cryptography for consensus algorithms;

- Using Wallet to store “Blockchain accounts.

When we talk about consensus algorithms, we are referring to a set of rules or procedures that, in a distributed network, a characteristic of Blockchain, help participants reach agreement on certain points, such as validating a transaction.

In Hyperledger Besu there are a few categories of consensus algorithms, such as:

Proof of Authority

This is a category of consensus algorithms that works well when the participants know each other and requires a minimum number of validating nodes. As the identity of each node is known, this reduces the risk of attacks that can occur on Blockchain networks.

- Proof of StakeThis is a category of consensus algorithms which, in a nutshell, can stipulate that participants must commit a financial amount in order to take part in the validation. In this case, the one who commits the most money has a prominent role in the validation. The idea is that the most invested participant, the one who has committed the most money, is responsible for validating a transaction

Proof of Work

This is a category of consensus algorithms widely used in Bitcoin, in which miners compete to solve challenges and thus earn rewards.

Among the three existing categories in Hyperledger Besu, ‘Proof of Authority’ has been defined for use by Real Digital.

In this model, the participants are known (members of the SFN network), and the inclusion of a new node is determined by a central authority, in this case the Central Bank.

Algorithms to support Hyperledger Besu

Hyperledger Besu supports three basic consensus algorithms by default: QBFT, IBFT 2.0 (proof of authority) and Clique.

QBFT and IBFT 2.0 are consensus algorithms widely used on the Quorum platform. A notable feature of these algorithms is that they require 2/3 of the nodes to validate a transaction, forming a super-qualified majority.

This provides a higher degree of confidence than the traditional 51% required by some other consensus algorithms.

The possibility of nodes getting to know each other can facilitate this process. However, it is important to note that adding extra nodes can increase the time needed for validation.

In the case of Real Digital, we don’t expect to have many validators, since the RSFN is a restricted network.

The algorithm

Clique

(proof of authority) algorithm, in addition to having characteristics typical of PoA (Proof of Authority) algorithms, stands out for the low computational cost required to add new nodes to the network.

A curious fact about this algorithm is that it was developed after an attack on an Ethereum test network.

There are two other algorithms available on Hyperledger Besu, but they are not commonly used in large private networks, as is the case with Real Digital.

Blockchain’s role in guaranteeing the security and transparency of Real Digital transactions

Blockchain plays a crucial role in guaranteeing the security and transparency of transactions in the context of the Central Bank’s digital currency.

This revolutionary innovation has decentralized features and advanced cryptography that contribute to data protection and the integrity of financial transactions.

Decentralized features

Decentralization is one of the main advantages of Blockchain which eliminates the need for intermediaries and the centralization of information.

In this system, transactions are stored in interconnected blocks, which are distributed across a network of nodes responsible for validating and recording operations.

This decentralization increases the security and resilience of the system, as it makes it more difficult to carry out attacks and fraud – it would be necessary to compromise most of the nodes in the network in order to alter the data.

In addition, decentralization promotes greater transparency, since all transactions are recorded and can be verified by all network participants.

Advanced encryption

The use of cryptography in Blockchain protects the integrity and authenticity of the information stored.

Transaction data is protected through the use of asymmetric encryption algorithms and cryptographic hash functions, which guarantee data security.

Asymmetric cryptography allows network participants to exchange information securely using public and private key pairs.

In practice, only the holder of the private key can decrypt the encrypted data with their public key.

Hash functions, on the other hand, are used to guarantee data integrity. In the context of Blockchain, they have multiple uses, such as:

- Identification of transactions;

- Checking the integrity of the blocks;

- Validating digital signatures of transactions;

- Generation of wallet addresses, also known as “wallets”;

- Creation of unique identifiers used by assets, smart contracts and others.

These cryptographic features make Blockchain a secure and reliable solution for recording and storing digital financial transactions.

About Eval

With a track record of leadership and innovation dating back to 2004, Eval not only keeps up with technological trends, but we are also in an incessant quest to bring news by offering solutions and services that make a difference to people’s lives.

With recognized value by the market, Eval’s solutions and services meet the highest regulatory standards of public and private organizations, such as SBIS, ITI, PCI DSS, and LGPD (General Law of Data Protection). In practice, we promote information security and compliance, increase companies’ operational efficiency, and reduce costs.

Innovate now, lead always: get to know Eval’s solutions and services and take your company to the next level.

Eval, safety is value.

Written by Arnaldo Miranda, Evaldo. Ai, reviewed by Marcelo Tiziano and designed by Caio.